- NFTs are not performing as expected.

- More sellers and less buyers can be a potential reason behind it.

What is NFT?

NFT stands for Non Fungible Tokens. As the name suggests, these tokens are non-fungible means each NFT is unique and cannot be exchanged on a one-to-one basis with another NFT. They differ from cryptocurrencies because each crypto unit is interchangeable with another. However, this is not the case with NFTs.

People collect NFTs with different intentions. Some collect them out of love for art, while other collect them as an investment to potentially earn money.

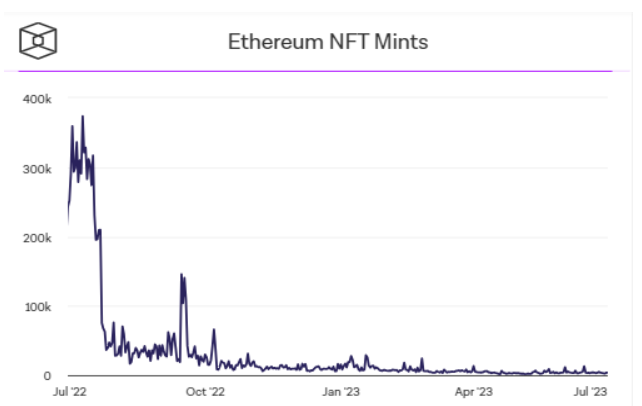

NFT Growth has Stagnated

BitcoinCasino.com has released some data about the forecast of the future NFT market. According to their findings, the NFT market is expected to reach approximately 2.7 Billion by 2025. However, many are worried about this prediction as it is less than half of the previous NFT forecast. NFT and Crypto enthusiasts were expecting a much higher growth rate, especially considering the Crypto market’s projected growth to US$ 6.716 Trillion by 2025.

The NFT market is also related to cryptocurrencies because both NFTs and cryptocurrencies are based on blockchain technology.

Crypto analysts have estimated that the low prediction for the NFT market could be a consequence of the crypto winter, a period of reduced interest and activity in the crypto space.

Similarly, Statista’s earlier forecast predicted the NFT market to generate $3.68 billion, but surprisingly, it has reduced its prediction by 56%. ccording to a recent prediction by Statista, the Non-Fungible Token market will generate only $1.6 Billion in 2023. This decline in forecasted revenue may indicate that investors are losing interest in investing in NFTs.

What are the Reasons Behind its Stagnation?

The main reason crypto analysts are expecting a much lower market cap for NFTs is that the number of sellers in the NFT marketplace has outpaced the number of buyers. Due to this demand-supply imbalance, the predicted NFT market cap is now lower than what was expected previously.

Major NFT projects have lost 95% of their value in investment.

Investors in the major NFT market are experiencing significantlosses, due to the decline in the value of NFTs.

There are many examples of NFTs that have significantly decreased in value recently, such as:

- Doodles, which previously held a market cap of 23 ether, now reduced to only 2.3 ethers.

- Invisible Friend, which was trading at 8 ETH, now has significantly reduced to 1.15 ETH.

- Moonbirds, a once popular NFT, had a value of 32 ETH at its peak but has now decreased to 2 ETH.

Interestingly, all these NFTs are not regular; they are all Bluechip NFTs. This is evident from the fact that the Blue chip NFT index, representing all the NFTs, has also fallen significantly. It reached an annual peak of 12.394 ether in July 2022, but now it has limited itself to 7.446 ether.