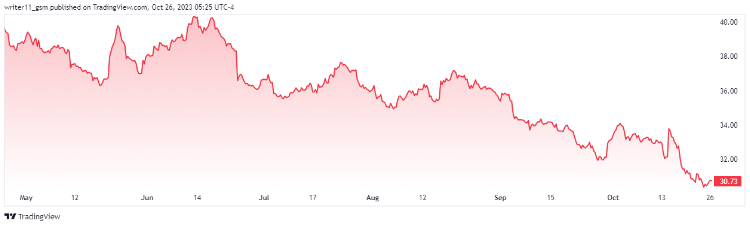

- The PFE stock price has declined by 20% in just the last six months.

- In the recent quarter report, the revenue of the company has declined by 54.1%.

Pfizer Inc. is an American pharmaceutical and biotechnology company that is most popularly known for its COVID-19 vaccine. The company was founded in the year 1849 by Charles Pfizer and Charles F. Erhart. The CEO of the company is Albert Bourla and has more than 83K employees.

Pfizer Inc. paid a total of $1.61 as a dividend on each share in the year 2022 and the dividend yielded by the company is 3.14%. The company pays dividends to its shareholders quarterly.

Pfizer Inc. has 5.644B shares floating in the market and the beta of the company is 0.42. This makes the stock price less fluctuating and volatile than the overall market. The basic EPS of the company is 3.82 USD which indicates the amount of money the company is making on each share.

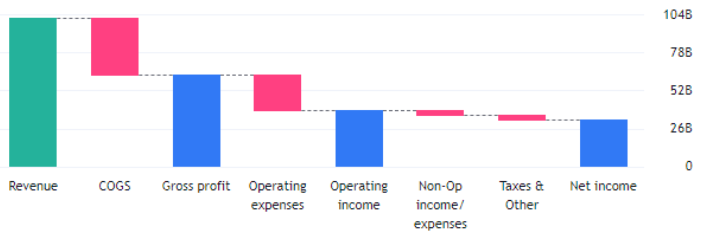

Financial Performance For PFE Stock

The recorded revenue for the Pfizer Inc. for the year ending 2022 is $100.33B. This is followed by COGS of $38.42B leading to a gross profit of $62.09B. Also, the operating expenses incurred by the company throughout the year stand at -$24.541B. The resulting net income of the company for the year 2022 is $31.36B.

PFE Stock Price Still Making Bearish Pattern, What Should Be Investor’s Next Step?

The Pfizer share price has declined by more than 50% from its all-time high price and is currently trading at a level of $30.73.

The share price has been making lower-low patterns for a long time declining to new lows and taking down the previous swing lows. The PFE stock does not show any signs of bullishness on the chart. Moreover, the decline in the price of the stock has led to the formation of a falling wedge pattern.

The PFE stock price is also trading below the crucial EMAs. The EMAs on the daily charts are also following a death cross and the price is leading to new lower swings. The RSI is also taking support at the oversold zones and has declined below the 14-day SMA.

Conclusion

Though Pfizer Inc. has reliable fundamentals the technicals are bearish indicating a strong downtrend. The stock is making lower lows and forming a bearish candlestick pattern. Thus, if the PFE stock price does not break above the falling wedge pattern, it might continue to decline to lower levels.

Technical Levels

- Support levels– $22.40 and $26.00

- Resistance levels– $34.00 and $40.30

Disclaimer

The information provided in this article, including the views and opinions expressed by the author or any individuals mentioned, is intended for informational purposes only. It is important to note that the article does not provide financial or investment advice. Investing or trading in cryptocurrency assets carries inherent risks and can result in financial loss.